EXECUTIVE SUMMARY

WHAT ASSETS CAN BE SECURITISED?

DEBT

ILLIQUID ASSETS

LIQUID ASSETS

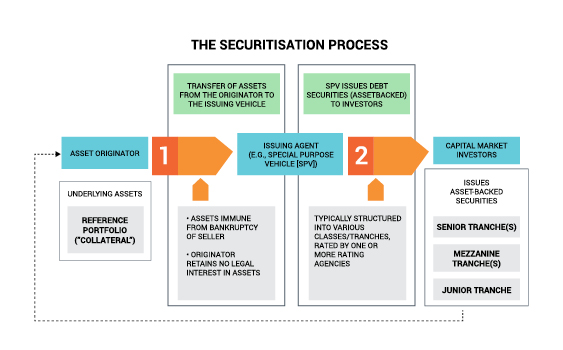

WHAT IS SECURITISATION?

CONVERTING NON-MARKETABLE SECURITIES TO MARKETABLE SECURITIES

PLATFORM PARTNERS

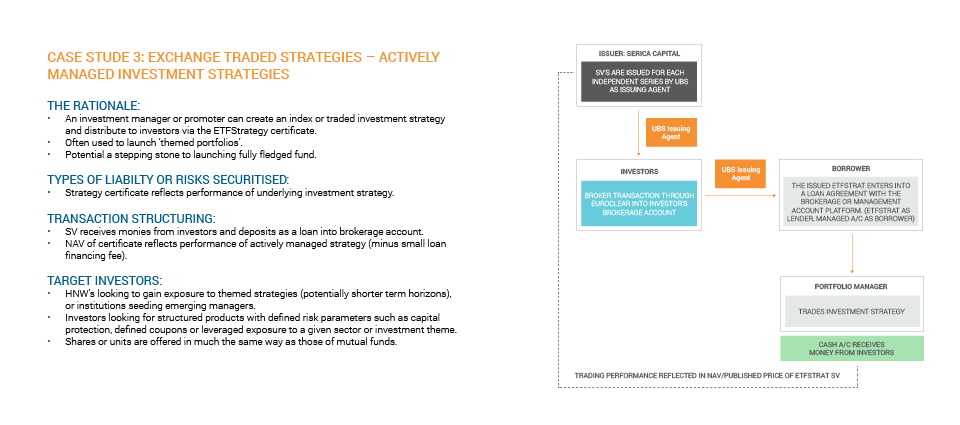

ISSUE AGENT AND PRINCIPAL PAYING AGENT: UBS AG. Zurich Branch UBS

Is one of the Issuing Agents and Principal Paying Agents for Serica Capital Securities under the SV platform. As Issuing Agent, UBS manages the issuance process, registers the security with ISIN in Euroclear and executes the matching of the Investor’s funds with the issued securities.

DEPOSITORY: Euroclear.

Euroclear is the world’s leading provider of domestic and cross-border settlement and related services for certain securities.

STOCK EXCHANGE: Six Securities

The Six Securities Stock Exchange is the established Swiss Stock Exchange, offering a diverse range of products and services and combining transparent, efficient and regulated equity, fixed income securities and derivatives markets in Switzerland.

AUDITOR: Deloitte

Deloitte is the Auditor for the Serica securitisation platform. As Auditor, Deloitte reviews the entire Serica exchange traded program on an annual basis, ensuring that each Serica SV Series is backed by the stated underlying assets.

SERVICING AGENT: IFIT Fund Services

IFIT is the servicing agent for the Serica SV Platform and acts as administrator for the Issuer’s operations. IFIT fiduciary responsibilities are mainly focussed on maintaining and protecting the interests of investors..

ISSUER: Serica Capital Securities SV Plc

The issuer for the Serica SV Platform, which is a Maltese Securitisation Company (SCC) created for the sole purpose of issuing the securitised cells.Serica Capital is a trading style and brand of the ARIA Capital Management.

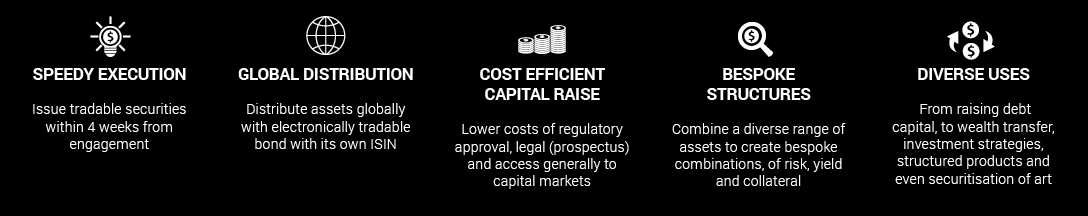

PLATFORM ADVANTAGES

SERICA EXCHANGE TRADED PRODUCTS

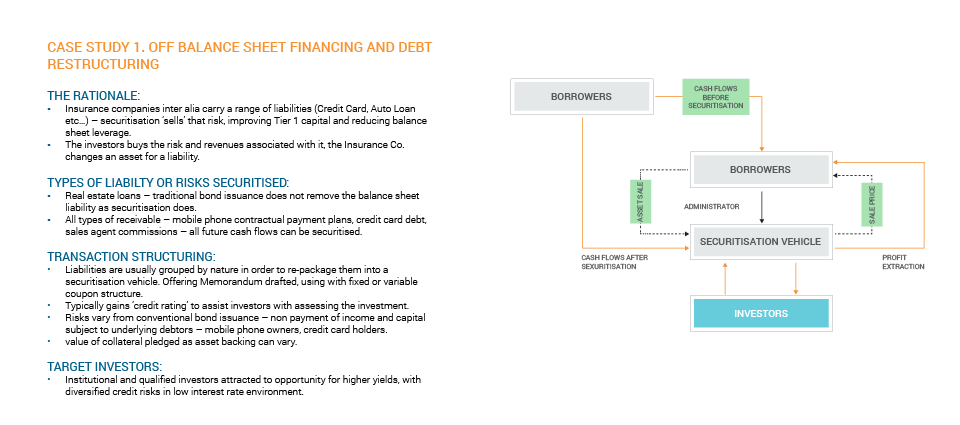

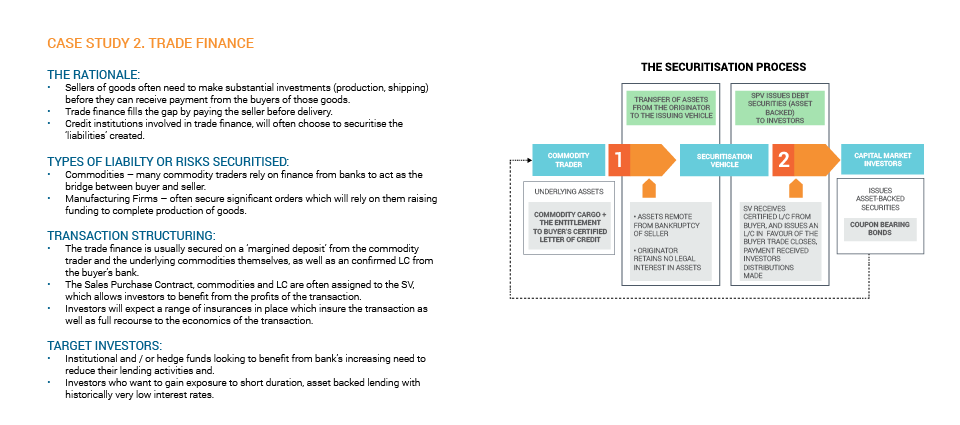

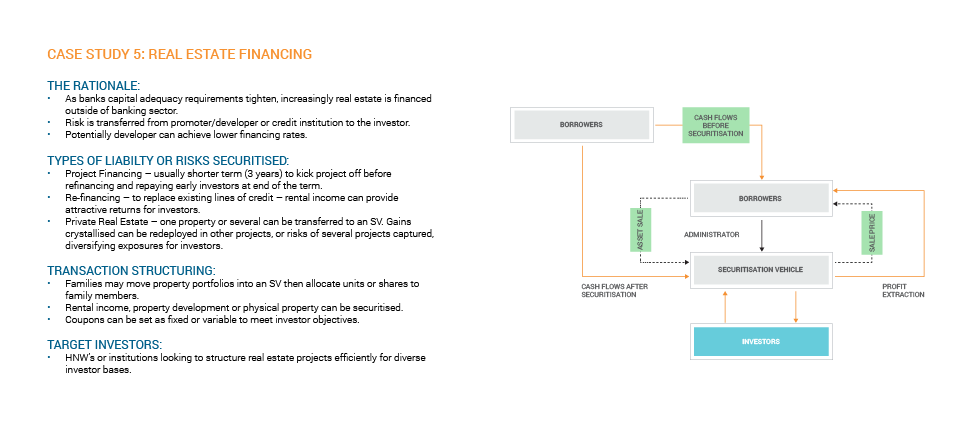

CASE STUDIES

London

(Associate Office)

Ground Floor, 2 Bell Court,

Leapale Lane, Guildford,

Surrey, GU4 1LY,

United Kingdom

Singapore

(Associate Office)

01-19#B The Arcade,

11 Collyer Quay.

Singapore 049317

MALTA

(Associate Office)

Alpine House

34 Naxxar Road

San Gwann,

Malta SGN 9032

Dubai

(Associate Office)

Office 1004, Park Place,

Sheikh Zayed Road,

PO Box 413670,

Dubai, United Arab Emirates

HONG KONG

(Associate Office)

No. 5, 17F, Bonham

Trade Centre, 50

Bonham Street, Sheng

Wan, Hong Kong